|

|

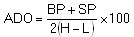

The A/D oscillator is a "normalized" oscillator.

An A/D oscillator is divided by a number that is a multiple of a period's range. Each period is treated independently. This "normalizes" the study and enables it to adapt to changing trading ranges.

Formula:

Where:

BP = buying power, or high-open

SP = selling power, or close-low

H = high

L = low

|

Parameter |

Function | ||||||||||||||

|

Color |

Default color is Yellow. To change the color, click on the color button:

Then choose the color you want from the Color Menu.

| ||||||||||||||

|

Graph |

Sets the drawing method for the study.

| ||||||||||||||

|

Line Style |

Sets the rendering technique of the graph parameter (if it is set to Line).

| ||||||||||||||

|

Line Width |

Sets the thickness of the study line.

|

Notes

The signals given by Accumulation/Distribution involve the concepts of divergence and confirmation.

Accumulation/Distribution issues a bullish signal on positive divergence. Beware of weak positive divergence. The object is to identify the dominant trend of the Accumulation/Distribution line. A two-week positive divergence weaker than while a month-long positive divergence. The converse of these principles apply to negative divergence.

The Accumulation/Distribution Line measures the volume force behind a move. As a volume-based study, Accumulation/Distribution helps determine whether instrument volume is increasing on advances or declines. There are several applications of this study:

Gauge money flow. An uptrend indicates prevalent buying while a downtrend indicates prevalent selling.

Identify divergence, positive and negative

Confirm the strength and sustain-ability of a move.

see, Kaufman, P. J., The New Commodity Trading Systems and Methods, New York: John Wiley & Sons, 1987.